Long Term Care Insurance Deduction 2025

Long Term Care Insurance Deduction 2025. By the karp law firm. The long term care policy must meet district of columbia's definitions.

This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Also included in this article is information on 2025 hsa contribution limits.

Also Included In This Article Is Information On 2025 Hsa Contribution Limits.

This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040).

It Discusses What Expenses, And Whose Expenses, You Can And Can't Include In Figuring The Deduction.

By the karp law firm.

The Long Term Care Policy Must Meet District Of Columbia's Definitions.

Images References :

Source: napkinfinance.com

Source: napkinfinance.com

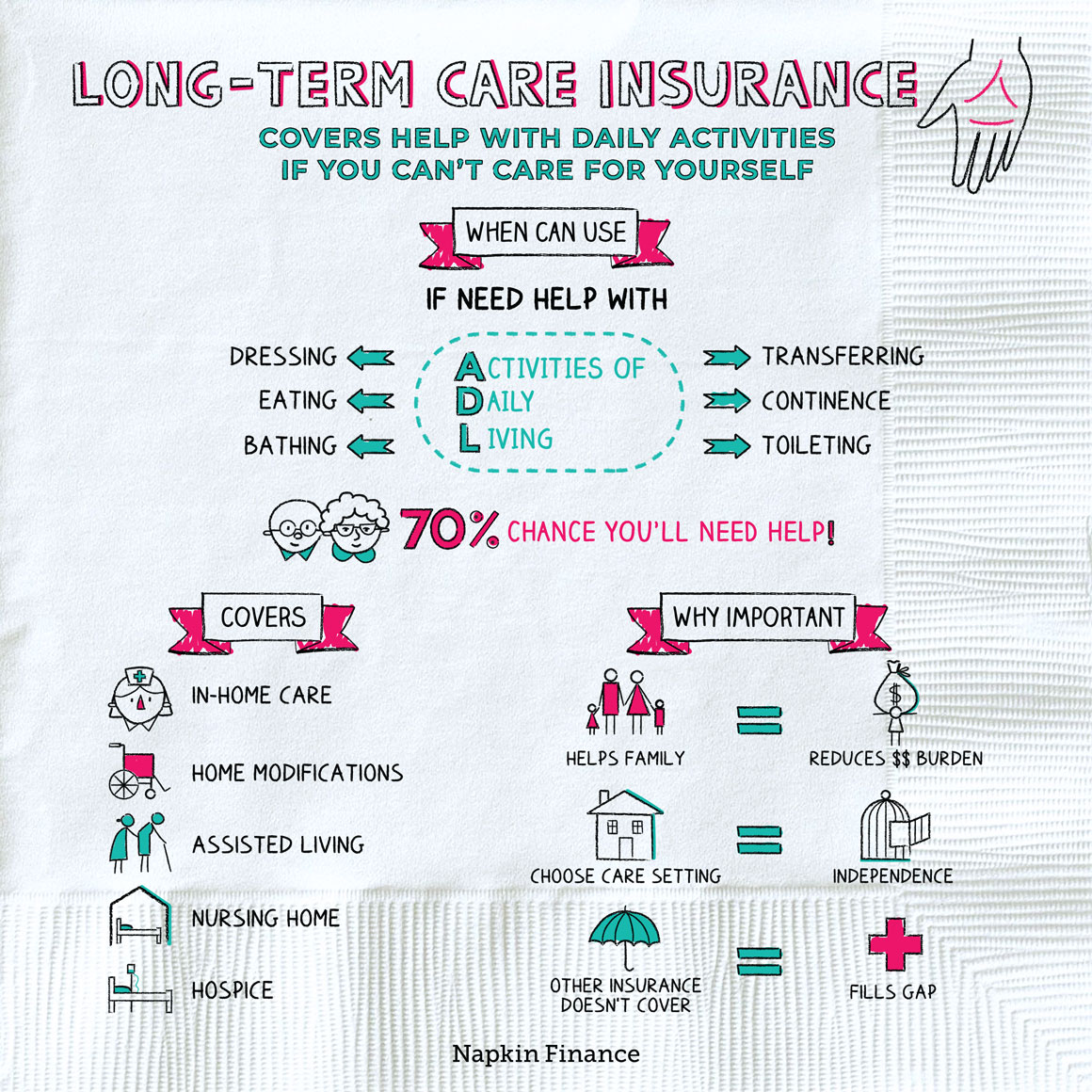

Long Term Care Insurance Napkin Finance, Also included in this article is information on 2025 hsa contribution limits. Many types of medical expenses are deductible from your taxes.

Source: mint.intuit.com

Source: mint.intuit.com

How Much Does LongTerm Care Insurance Cost? Mint, The just announced 2025 limits for an individual age 70 or more is $5,880, according to aaltci. It explains how to treat reimbursements and how to figure the deduction.

![Long Term Care Insurance Cost [Best Rates & Quotes] Insurance and Estates](https://www.insuranceandestates.com/wp-content/uploads/long-term-care-insurance-costs-e1513090092925.jpg) Source: www.insuranceandestates.com

Source: www.insuranceandestates.com

Long Term Care Insurance Cost [Best Rates & Quotes] Insurance and Estates, A deduction for long term care insurance premiums paid annually is allowed from gross income provided that the tax deduction does not exceed $500/year per individual. “this is still a significant tax deduction,” slome explains.

Source: lifescapelaw.com

Source: lifescapelaw.com

Understanding Federal Longterm Care Insurance Program Lifescape Law, The long term care policy must meet district of columbia's definitions. Deduction a deduction for long term care insurance premiums paid annually ius allowed from gross income provided that the deduction does no exceed $500 per year, per individual.

Source: makefinancialcenter.com

Source: makefinancialcenter.com

How much does nursing care insurance cost? Make Financial Center, Deduction a deduction for long term care insurance premiums paid annually ius allowed from gross income provided that the deduction does no exceed $500 per year, per individual. However, there are limits on the amount of annual premiums you can deduct.

Source: ladimerlaw.com

Source: ladimerlaw.com

Long Term Care Planning Ladimer Law Office PC, Enrollees in the federal long term care insurance program (fltcip) are being mailed letters the week of september 11 indicating the amount their fltcip premiums will increase, starting in january 2025. For an individual who itemizes tax deductions, medical expenses are deductible to the extent that they exceed current amount required to meet the individual’s adjusted gross income (agi).

Source: www.aarp.org

Source: www.aarp.org

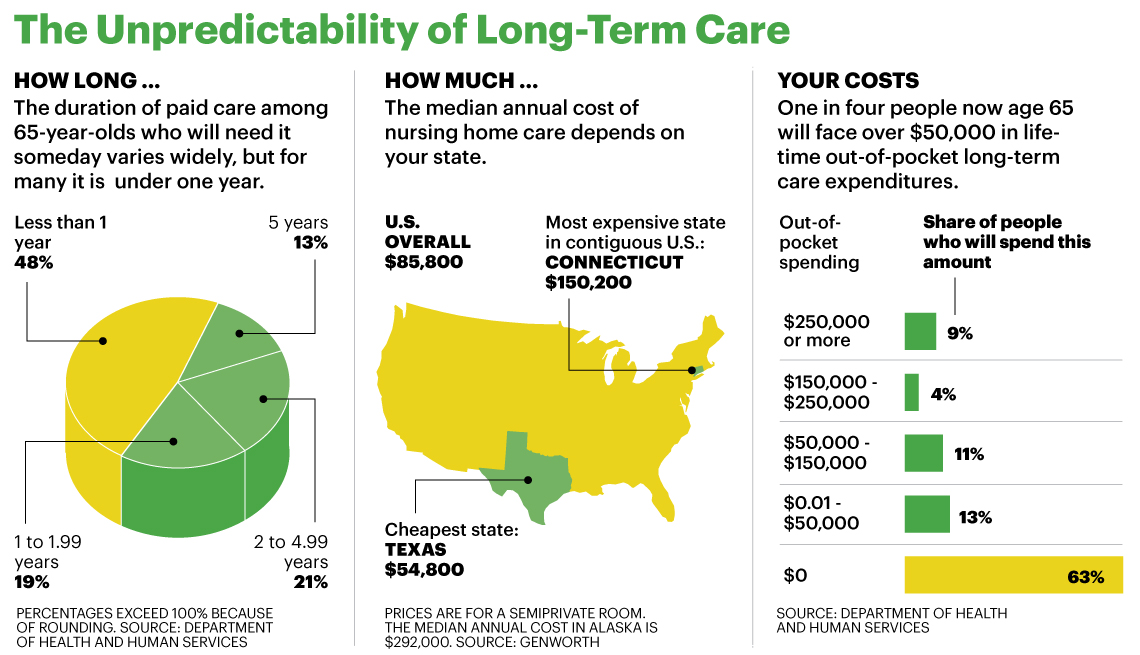

5 Facts You Should Know About LongTerm Care Insurance, The just announced 2025 limits for an individual age 70 or more is $5,880, according to aaltci. To claim the deduction, your total.

Source: milvidlaw.com

Source: milvidlaw.com

LongTerm Care Insurance Premiums Have Soared in Past Year, However, there are limits on the amount of annual premiums you can deduct. Individuals can deduct a portion of their premiums as medical expenses.

Source: www.meetbreeze.com

Source: www.meetbreeze.com

Is LongTerm Care insurance Worth It For You? Breeze, This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Enrollees will be provided options for accepting the premium increase in full, reducing coverage in exchange for a lower (or no) premium.

Source: abbyservices.com

Source: abbyservices.com

Accessing A Long Term Care Insurance Policy 1 Great Way To Pay For In, Enrollees in the federal long term care insurance program (fltcip) are being mailed letters the week of september 11 indicating the amount their fltcip premiums will increase, starting in january 2025. This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040).

This Publication Explains The Itemized Deduction For Medical And Dental Expenses That You Claim On Schedule A (Form 1040).

The just announced 2025 limits for an individual age 70 or more is $5,880, according to aaltci.

The 2025 Maximum Deductible Limit For That Age Band Is $5,960.

First, in order to be eligible for a tax deduction, the.