Federal Tax Incentives For Electric Vehicles Images

Federal Tax Incentives For Electric Vehicles Images. The 2022 inflation reduction act (ira) drastically changed the incentives available for electric vehicles. The total federal incentive amount depends on the capacity of the battery used to power your car, and state and/or local incentives may also apply.

It should be easier to get because it’s now available as an instant rebate at. The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

Here Are The Rules, Qualifications And How To Claim The Credit.

The tax credits for purchasing electric vehicles (evs) got a major overhaul on jan.

A $7,500 Tax Credit For Electric Vehicles Has Seen Substantial Changes In 2024.

The other four vehicles offer a total tax credit.

Michigan Is The Home Of America’s Legacy Automakers, And Even Though The Detroit Brands Are Beginning To Develop And Market More Electrified Vehicles, They’re A.

Images References :

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Fewer cars now qualify for federal credits. The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, Commercial evs will also be eligible for federal tax credits for the first time ever, up to 30% of the sales price. It should be easier to get because it's now available as an instant rebate at.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, Fewer cars now qualify for federal credits. Here are the rules, qualifications and how to claim the credit.

Source: www.americanactionforum.org

Source: www.americanactionforum.org

The IRA's EV Tax Credits AAF, At present, only 10 evs — including three tesla models — will qualify for the full $7,500 credit in 2024. A $7,500 tax credit for electric vehicles has seen substantial changes in 2024.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, Here are the rules, qualifications and how to claim the credit. The 2022 inflation reduction act (ira) drastically changed the incentives available for electric vehicles.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, However, the inflation reduction act’s alternative fuel refueling. A $7,500 tax credit for electric vehicles has seen substantial changes in 2024.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Tax Credit Electric Vehicle Update Tax Payments Deferred, Americans can purchase 91 models of electric cars and trucks — but as of tuesday, only 14 of them will qualify for federal tax breaks intended to persuade. Fewer cars now qualify for federal credits.

Source: www.nytimes.com

Source: www.nytimes.com

Which Electric Vehicles Qualify for Federal Tax Credits? The New York, Search incentives and laws related to alternative fuels and advanced vehicles. The total federal incentive amount depends on the capacity of the battery used to power your car, and state and/or local incentives may also apply.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, Use this tool to find generally available and qualifying tax credits, incentives and rebates that may apply to your purchase or lease of an electric vehicle. Search incentives and laws related to alternative fuels and advanced vehicles.

Source: www.c2es.org

Source: www.c2es.org

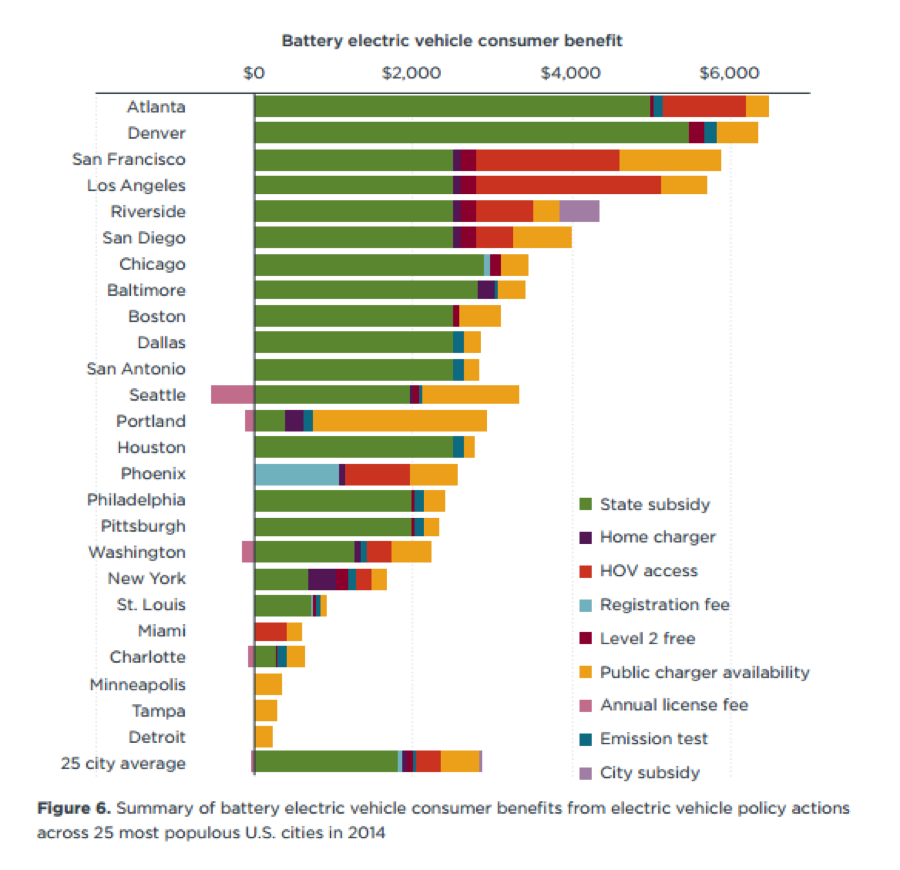

US cities offer diverse incentives for electric vehicles — Center for, The tax credits for purchasing electric vehicles (evs) got a major overhaul on jan. The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

Search Incentives And Laws Related To Alternative Fuels And Advanced Vehicles.

Department of the treasury and internal revenue.

Use This Tool To Find Generally Available And Qualifying Tax Credits, Incentives And Rebates That May Apply To Your Purchase Or Lease Of An Electric Vehicle.

Fewer cars now qualify for federal credits.