5695 Form 2024

5695 Form 2024. Although these credits are claimed using a single tax form, there are a few other differences than how the credit is calculated. The residential clean energy credit, commonly known as the solar tax credit, is one of the biggest draws for homeowners turning to solar energy.

Home » blog » here’s how to claim the solar tax credit on form 5695. Claiming tax credits for solar panels.

About Press Copyright Contact Us Creators Advertise Developers Terms.

Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government.

Nirmal Nr Lottery Is One Of The 7 Lucky Draws Held Every Week.

The union public service commission has rescheduled the upsc cse 2024 to june 16 due to lok sabha elections.

The Credit Percentage Rate Phases Down To 26 Percent For Property Placed In Service In 2033 And 22 Percent For Property Placed In Service In 2034.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Form 5695 Fill out & sign online DocHub, The union public service commission has rescheduled the upsc cse 2024 to june 16 due to lok sabha elections. Home » blog » here’s how to claim the solar tax credit on form 5695.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

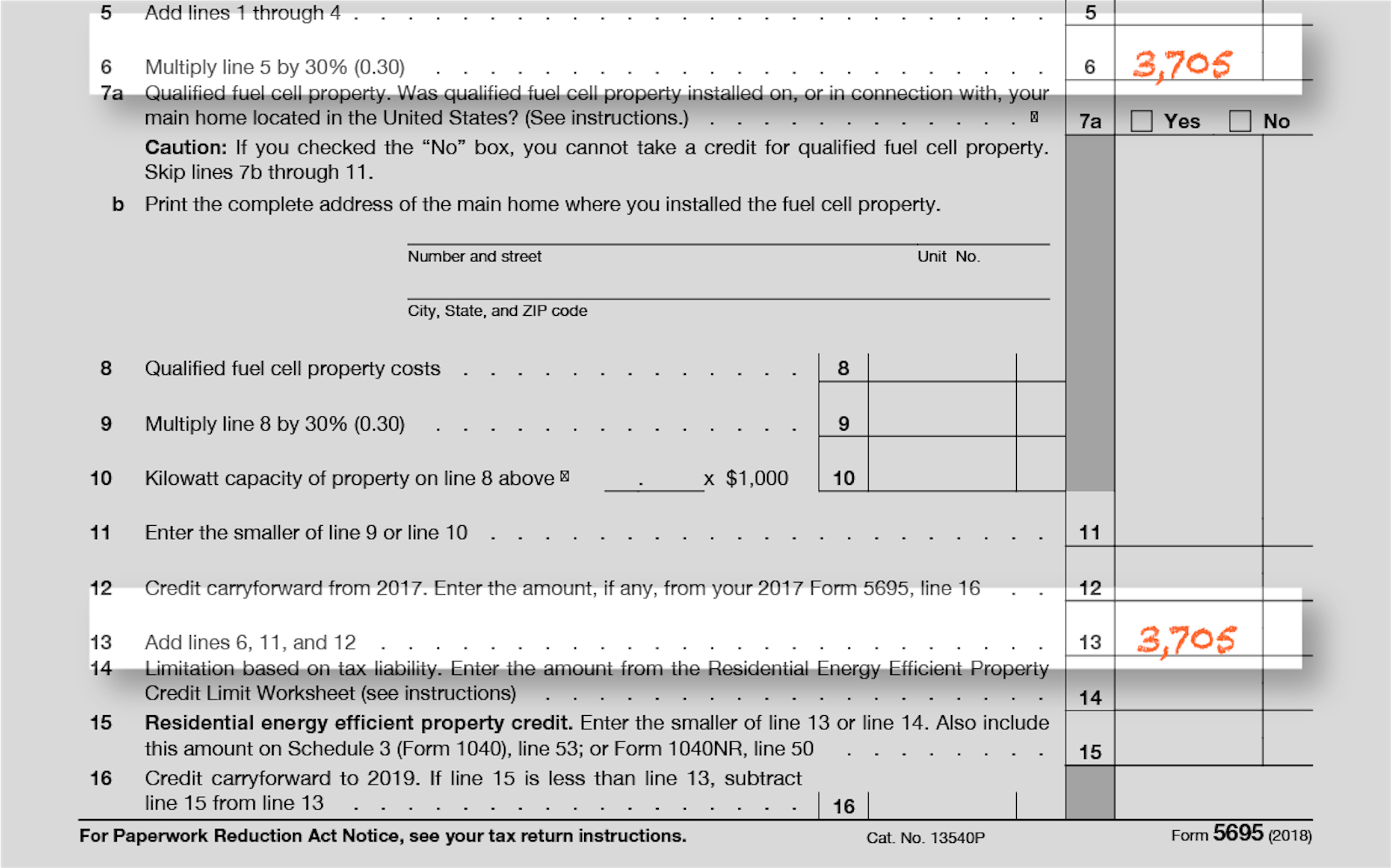

IRS Form 5695 Instructions Residential Energy Credits, Form 5695 energy tax credits form 5695 instructions as taxpayers prepare for the upcoming tax seasons of 2023 and 2024, understanding what can be claimed on. Solar electric property costs (form 5695, part i, line 1) solar water heating property costs (form 5695, part i, line 2) fuel cell property costs (form 5695, part i, line 8) kilowatt.

Source: unboundsolar.com

Source: unboundsolar.com

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, Solar electric property costs (form 5695, part i, line 1) solar water heating property costs (form 5695, part i, line 2) fuel cell property costs (form 5695, part i, line 8) kilowatt. This residential energy credit can save you a lot.

Source: www.solar.com

Source: www.solar.com

How to File the Federal Solar Tax Credit A Step by Step Guide, Although these credits are claimed using a single tax form, there are a few other differences than how the credit is calculated. Form 5695 energy tax credits form 5695 instructions as taxpayers prepare for the upcoming tax seasons of 2023 and 2024, understanding what can be claimed on.

Source: printableformsfree.com

Source: printableformsfree.com

Irs Form 5695 Instructions 2023 Printable Forms Free Online, Solar electric property costs (form 5695, part i, line 1) solar water heating property costs (form 5695, part i, line 2) fuel cell property costs (form 5695, part i, line 8) kilowatt. How to claim the solar tax credit:

Source: unboundsolar.com

Source: unboundsolar.com

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government. Sb 6025 protects consumers from predatory loans by making it harder for unscrupulous lenders to evade existing legal protections.

Source: unboundsolar.com

Source: unboundsolar.com

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, March 24, 2024 21:08 xinhua. How to claim the solar tax credit:

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 5695 Instructions Residential Energy Credits, With nerdwallet taxes powered by column tax, registered nerdwallet members pay one fee,. Go to the personal info tab and click on federal taxes.

Source: pdf.wondershare.com.br

Source: pdf.wondershare.com.br

Como Você Pode Preencher o Formulário IRS 5695, By submitting your details above and clicking on the 'read now' button, you confirm that you are happy for one of the representatives. The residential clean energy credit, commonly known as the solar tax credit, is one of the biggest draws for homeowners turning to solar energy.

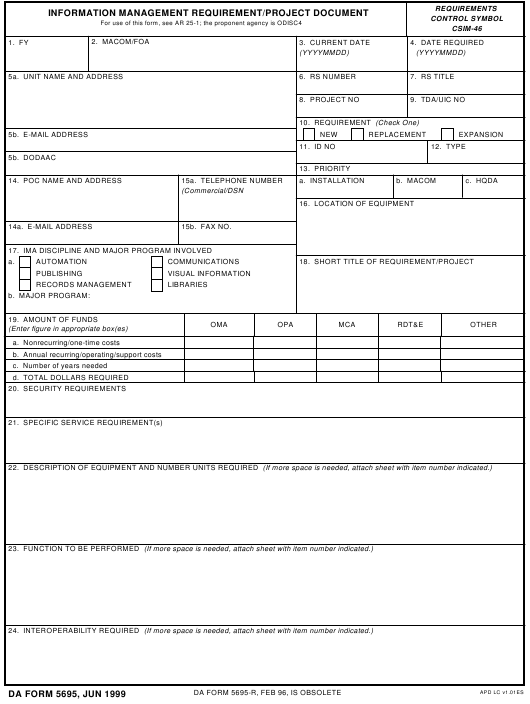

Source: army.myservicesupport.com

Source: army.myservicesupport.com

Download Fillable da Form 5695, Here’s how to claim the solar tax credit on form 5695. Irs form 5695 instructions (2024) written by ben zientara , edited by catherine lane.

Sb 6025 Protects Consumers From Predatory Loans By Making It Harder For Unscrupulous Lenders To Evade Existing Legal Protections.

Simple tax filing with a $50 flat fee for every scenario.

A Form 1040 Return With Limited Credits Is One That's Filed Using Irs.

The upsc has announced 1,056 cse and.